A Biased View of Offshore Banking

Table of Contents9 Simple Techniques For Offshore BankingSome Known Incorrect Statements About Offshore Banking The Main Principles Of Offshore Banking About Offshore BankingSome Of Offshore Banking

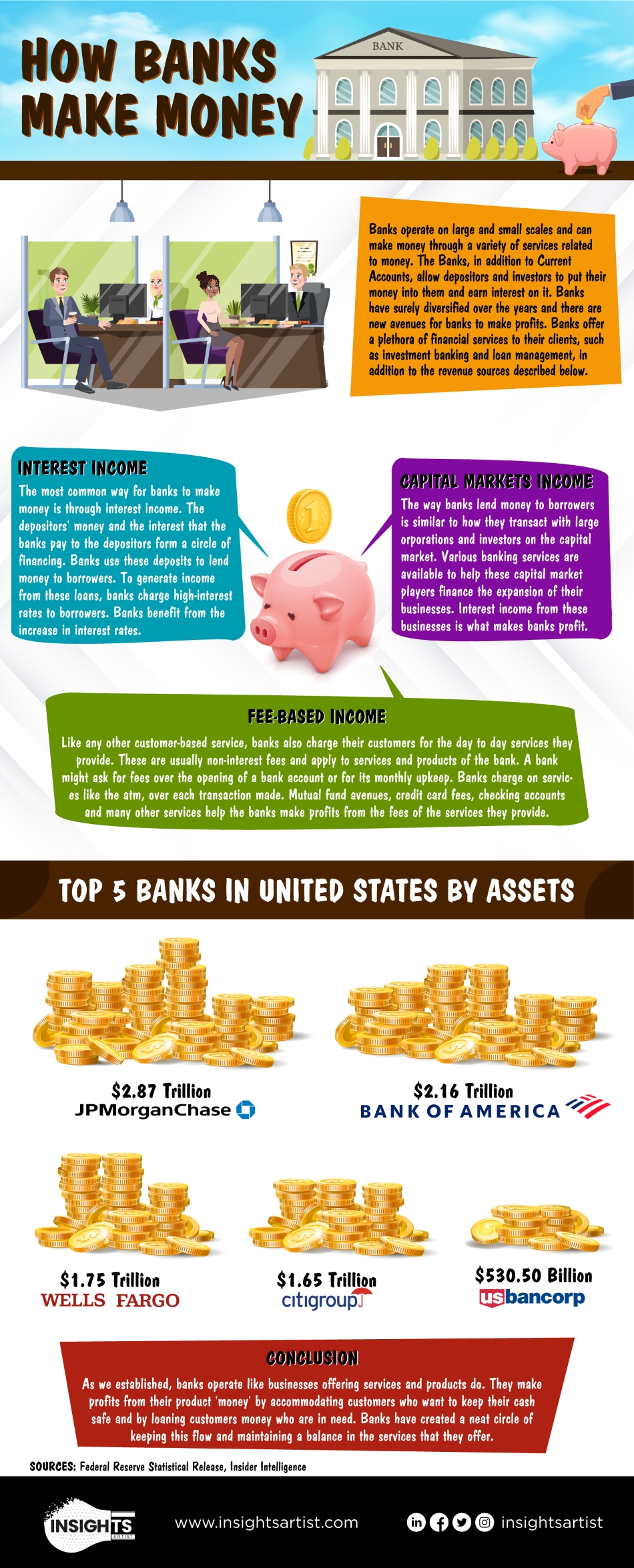

Some common sorts of fundings that financial institutions offer consist of: If your current economic institution doesn't offer the solutions mentioned over, you may not be getting the very best financial service possible. At First Financial institution, we are dedicated to aiding our clients obtain the most out of their cash. That is why we provide various sorts of banking solutions to fulfill a variety of demands.

Pay expenses, lease or top up, buy transport tickets and also more in 24,000 UK areas

If you get on the hunt for a new monitoring account or you intend to begin spending, you may need to establish apart time in your routine to do some study. That's since there are several type of financial institutions as well as banks. By recognizing the various sorts of financial institutions as well as their functions, you'll have a much better sense of why they are necessary as well as just how they play a role in the economic climate.

The Only Guide to Offshore Banking

In terms of financial institutions, the main financial institution is the head honcho. Main banks take care of the cash supply in a solitary country or a series of countries.

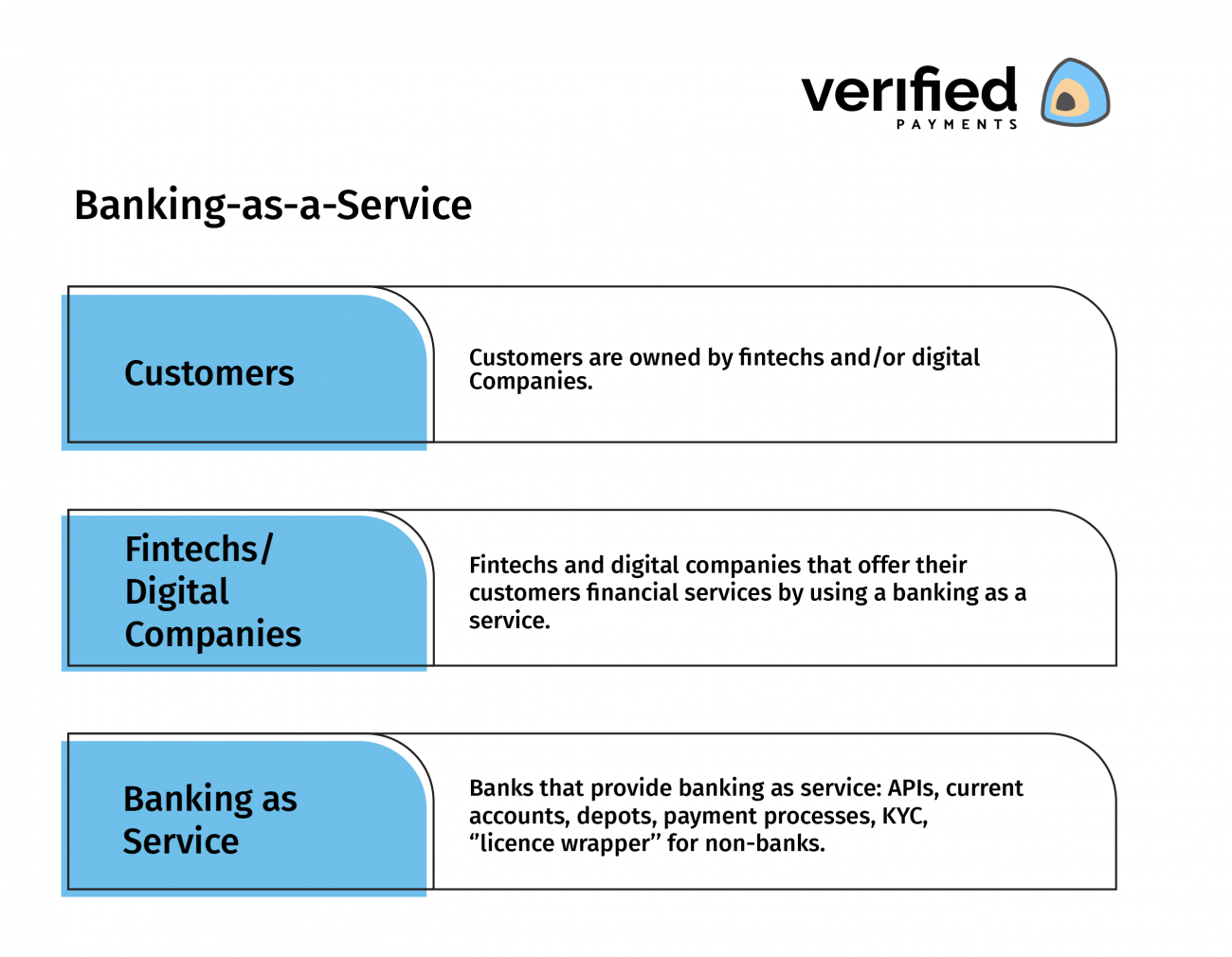

Retail banks can be conventional, brick-and-mortar brand names that clients can access in-person, on-line or via their cellphones. Others just make their tools and accounts offered online or through mobile apps. Although there are some kinds of business financial institutions that help day-to-day consumers, industrial banks have a tendency to focus on supporting organizations.

Much like the basic managed financial institutions, darkness financial institutions deal with credit report and different kinds of assets. They get their financing by borrowing it, linking with capitalists or making their very own funds instead of making use of cash released by the main bank.

Cooperatives can be either retail financial institutions or industrial banks. What differentiates them from other entities in the economic system is the truth that they're commonly neighborhood or community-based associations whose participants aid determine how the company is run. They're run democratically and also they offer finances and checking accounts, amongst other things.

Not known Factual Statements About Offshore Banking

they usually take the form of cooperative credit union. Like banks, credit unions issue lendings, supply savings and examining accounts as well as fulfill various other economic needs for consumers and companies. The difference is that banks are for-profit companies while credit history unions are not. Debt unions drop under the direction of their very own participants, that make choices based upon the point of views of elected board participants.

Participants benefited from the S&L's solutions and gained even more additional resources passion from their financial savings than they could at industrial banks (offshore banking). Not all financial institutions offer the same objective.

With time, they have actually been widely used by both innovative reserve supervisors as well as by those with even more uncomplicated needs. Sight/notice accounts and fixed and also floating price deposits Fixed-term deposits, also denominated in a basket of money such as the SDR Flexible amounts and maturations An attractive investment commonly used by reserve supervisors looking for extra return and impressive credit quality.

This paper provides a strategy that banks can utilize to help "unbanked" householdsthose that do not have accounts at deposit institutionsto join the mainstream monetary system. The main function of the approach is to assist these families develop savings and also improve their credit-risk profiles in order to decrease their price of settlement services, remove a common resource of individual tension, browse around this site and get to lower-cost resources of credit history.

More About Offshore Banking

Second, it will supply them a set of solutions much better created to satisfy their requirements. Third, it is better structured to assist the unbanked come to be typical bank customers. Fourth, it is also most likely to be a lot more lucrative for financial institutions, making them more going to apply it. Numerous surveys have actually examined the socioeconomic attributes of the about 10 million homes that do not have checking account.

They have no prompt demand for credit rating or do not locate that their unbanked status excludes them from the debt that they do require. Repayment solutions are additionally not troublesome for a range of factors.

The majority of banks in metropolitan locations won't pay paychecks for individuals that do not have an account at the bank or who do not have an account with sufficient funds in the account to cover the check. It can be rather costly for someone living from income to income to open up a bank account, also one with a reduced minimum-balance requirement.

Each helpful hints jumped check can cost the account owner $40 or more considering that both the check-writer's bank and also the vendor that approved the check commonly penalize costs. It is likewise costly and also bothersome for bank consumers without inspecting accounts to make long-distance settlements. Nearly all financial institutions charge at the very least $1 for money orders, and also several fee as high as $3.

Getting The Offshore Banking To Work

As kept in mind in the introduction, this paper argues that one of the most efficient and also inexpensive means to bring the unbanked right into the banking system should involve five actions. Below is a description of each of those measures as well as their rationales. The very first step in the proposed approach contacts participating financial institutions to open specialized branches that offer the complete variety of industrial check-cashing services along with typical customer banking services.